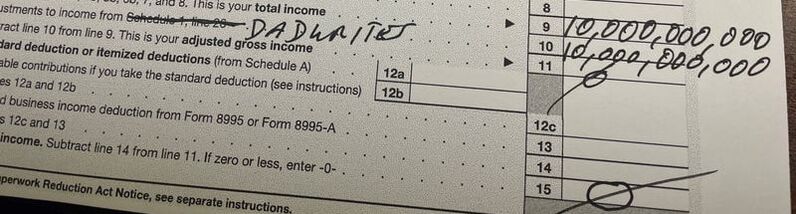

Tick, tick, tick, you can feel the pressure build as April 15 approaches and it’s time to pay the viper over at the Internal Revenue Service. After two years of stimulus checks, special tax credits and delayed filings, this tax season is especially painful for Americans. Or, it was painful until the accounting geniuses at Dad Writes got to work. Thanks to our cracked team of financial magicians, millions of working stiffs can maximize deductions, minimize income and make out like bandits—"legally.” We’ve examined every word of uild Back Better, Restore America, Help Apple Survive, Wall Street Orphans Support, and all the other one-time, emergency, never-to-be-repeated (wink wink) tax packages that Congress came up with over the past three years and we can absolutely “guarantee” that all of these special deals are 182.9% “foolproof.” Sharpen your pencils and don your green eyeshades as you calculate your tax savings, now that you can…

Remember, keep these incredible tax tips to yourselves, as only loyal fans of Dad Writes are eligible to claim these unbelievable benefits. Even better, you won’t need to worry about making any mistakes with your filings this year, since Congress has prohibited the IRS from auditing any taxpayers ever again. Trust us on this. We know these things. *It’s always possible that rules will change over the next few days, so you’ll want to consult your tax advisor, just in case. In the meantime, you’ll definitely want to click here to subscribe so you’ll have something to read while waiting for your sentencing hearing.

0 Comments

Leave a Reply. |

Who writes this stuff?Dadwrites oozes from the warped mind of Michael Rosenbaum, an award-winning author who spends most of his time these days as a start-up business mentor, book coach, photographer and, mostly, a grandfather. All views are his alone, largely due to the fact that he can’t find anyone who agrees with him. Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed