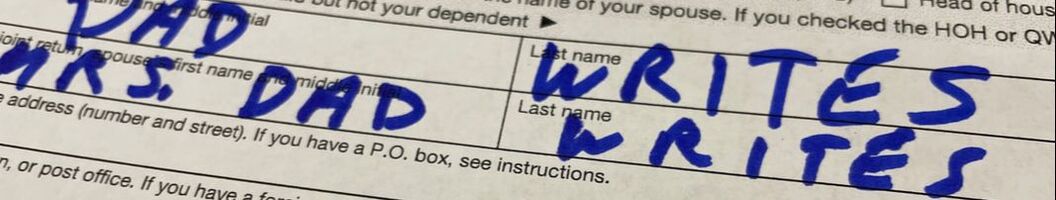

I can’t tell you how excited I am to file my tax return this year, along with all the other PATRIOTS who say the United States is the BEST COUNTRY ever. Tax Day is such a great holiday, an opportunity for all REAL AMERICANS to step up and be counted in the GREATEST DEMOCRACY with the GREATEST CONSTITUTION and the GREATEST PEOPLE. (Well, the greatest people if we exclude you-know-who from that other tribe.) Frankly, I’m surprised the IRS site doesn’t have a tab to give them a tip when we e-file our payments. I tip the guy who brings me my cheeseburgers, so I should be able to tip the fine folks at the IRS who are handling my contribution to democracy. Maybe next year. In the meantime, I’m excited to learn that our national government is an even bigger bargain than in the past, thanks to some really key new deductions that are available to selected taxpayers. (Readers will want to check with their own advisors to see if you qualify, of course.) Some of the new deductions are incredibly generous, just what you’d expect from your favorite Uncle, including:

I’m taking advantage of all of these special deductions and it looks like I’ll be getting a big refund from the BEST COUNTRY EVER. Not only am I scheduled to receive of $2,813,938, but my accountant thinks it’s pretty certain that the U.S. government will give me secure housing for the next 15-20 years, or maybe even my entire life. Is this a great country, or what? Before you check with a tax professional to find out which of these amazing deductions is available to you, be sure to click here to subscribe to Dad Writes for more unbelievable advice.

0 Comments

Leave a Reply. |

Who writes this stuff?Dadwrites oozes from the warped mind of Michael Rosenbaum, an award-winning author who spends most of his time these days as a start-up business mentor, book coach, photographer and, mostly, a grandfather. All views are his alone, largely due to the fact that he can’t find anyone who agrees with him. Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed